TYPES OF CLAIMS

HEADQUARTERED IN THE

GAINESVILLE AREA

about commercial and residential property losses.

SERVING COMMUNITIES IN FLORIDA, & THE CAROLINAS

¡HABLAMOS ESPAÑOL! LLAMENOS HOY SI HA SUFRIDO DAÑOS A SU PROPIEDAD O NEGOCIO

AFFECTED BY A HURRICANE?

YOU HAVE UP TO 3 YEARS TO FILE YOUR CLAIM

CALL US TODAY TO SCHEDULE

A FREE CONSULTATION. WE’RE AVAILABLE

24 HOURS A DAY, 7 DAYS A WEEK.

WHAT IS A PUBLIC

ADJUSTER?

A Public Adjuster is an insurance professional that is hired to represent the insured. We handle residential and commercial claims ,Property Damage Claims and the related loss of income which results from such perils as wind, water, fire, theft & vandalism, flood, etc. It is our duty to document your loss and negotiate the best possible settlement while offering you guidance through the claims process.

Do I really need to

NEED TO HIRE A PUBLIC

ADJUSTER?

When you’ve just suffered a loss to your home or business resulting from a pipe burst, a fire, hurricane or some other chaotic event, navigating an insurance claim and ensuring a quick financial recovery can be difficult and emotionally draining; without the expertise in filing a claim, policyholders are often at a great disadvantage. You may ask yourself questions like:

- Should I file a claim?

- What is my claim really worth?

- Will my insurance company pay me a fair settlement for my damages?

You may also be dealing with other matters such as finding housing, an alternate business location, or simply going about your daily responsibilities, like work and family.

That’s where we come in. Public insurance adjusters are loss professionals that work only for you, the policyholder. The insurance company has their own professional expert representing them. Shouldn’t you?

“Many people describe their insurance claim experience as a full time job. Negotiating a fair claim settlement can be very challenging, especially after an emotionally devastating catastrophe.” “If you rely completely on your insurance company to calculate the amount of damage and what you’re owed, you are unlikely to recover a full or fair settlement.”

-Amy Bach

United Policyholders Co-Founder

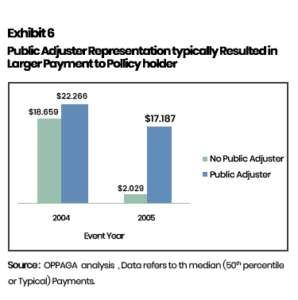

PUBLIC ADJUSTER REPRESENTATION TYPICALLY resulted in HIGHER SETTLEMENTS THAN THOSE WITHOUT PUBLIC ADJUSTERS."

Policyholders that filed catastrophe claims in 2008 and 2009 generally received larger insurance settlements than policyholders that did not hire these persons. The typical payment to a policyholder represented by a public adjuster was $22,266 for claims filed in 2008 and 2009 related to the 2004 hurricanes (see Exhibit 6). In contrast, policyholders who did not use a public adjuster received typical payments of $18,659.The difference in payments was larger for claims related to 2005 hurricanes, with public adjuster claims resulting in payments that were 747% higher.

IF YOU FEEL THE SERVICES OF A PUBLIC ADJUSTER ARE RIGHT FOR YOU, CALL (800) 320-8796 TODAY OR FILL OUT THE FORM BELOW TO REQUEST A CONSULTATION.

Contact Us

Specializing in Insurance Adjusting, Loss Consulting, and Appraisal Services. Settle your claim with team of experts on your side.

Contact Us

26015 NW 160th PL

High Springs, FL 32643

| BY APPOINTMENT ONLY |

(800) 320 - 8796

License #P182212.